The Bank of England Ate My iPhone

A currency that preserves its value is the economic essence of nationhood.

When the first iPhone launched in 2007, I paid £500.

Had I instead spent that money on gold coins, they’d be worth roughly £2,500 today — enough to buy the latest top-end iPhone and a pair of wireless earplugs.

That simple comparison reveals how poorly sterling has performed as a store of value over the last 18 years.

And things are about to get worse — fast.

A Market Rebellion

When the Bank of England (BoE) cut rates to 4 % in August, something odd happened:

the cost of government borrowing went up.1

The BoE lost its economic breathing room because

a) inflation stayed above target, and

b) the new Labour Chancellor had already borrowed far more than forecast.

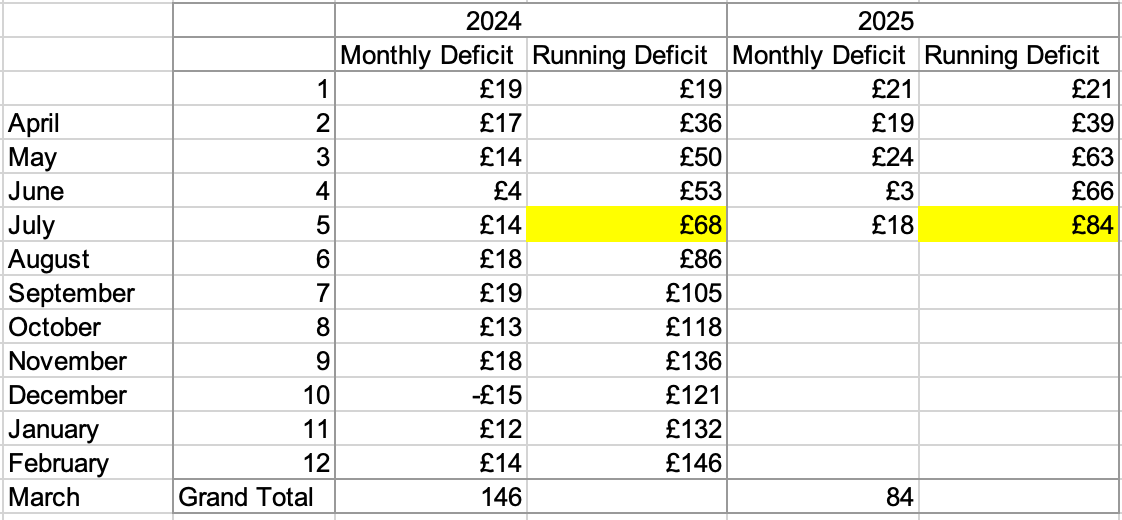

According to Treasury data, the running deficit rose from £68 bn in August 2024 to £84 bn in August 2025 — a 23 % increase in just a year. 2

The table below shows both the monthly UK deficit and the running deficit for financial years 2024 and 2025. The deficit is the different between income and expenditure, representing the amount being borrowed by Rachel Reeves to cover her funding gap:

As Roger Lee, Head of Equity Strategy at Cavendish, observes, that’s a £40 bn overshoot versus expectations.3

The Office for Budget Responsibility (OBR) had assumed falling rates would shrink borrowing costs.

Instead, revenues are slowing, spending is rising, and debt-servicing costs are soaring.

Lee reckons the deficit will hit £190 bn this financial year, not the £120 bn forecast.

That’s unsustainable — and it’s why I doubt Prime Minister Starmer will survive a full term.

Taxing Into Decline

Emergency tax hikes in November might buy Labour some time,

but the government is already on the dark side of the Laffer curve — squeezing revenue by over-taxing growth.

Take the Energy Profits Levy (EPL):

introduced at 25 % by Sunak in 2022, raised to 35 % in 2023,

and hiked again to 38 % by Rachel Reeves in 2024.

That means total taxation on North Sea oil and gas profits has risen from 65 % to 78 %.

Production has plunged, taking tax receipts with it — revenues forecast at £20.7 bn in 2023-24 came in at just £5.4 bn, and are falling further.4

This is what economic suicide by tax looks like:

Britain is taxing itself into stagnation, sleepwalking toward another financial crisis.

What Happens Next — and When

As the deficit drifts toward £190 bn, UK borrowing costs will first creep up — then spike.

For comparison, the EU’s Stability and Growth Pact limits deficits to 3 % of GDP.

At £190 bn, Britain’s deficit would be roughly 7 % of GDP.

Here I diverge from Roger Lee.

He expects the BoE to restart Quantitative Easing (QE),

buying government bonds like a mini-IMF — but only if the Treasury cuts spending.

I don’t buy it.

The BoE’s record shows little appetite for discipline:

2009: Launched QE after the crash — £92 bn initially, ballooning to £900 bn by 2020 with barely a protest about inflation.

2020-22: Completely missed the post-COVID inflation wave.

2023: Saddled taxpayers with £150 bn in losses from buying back QE-era debt. 5

2022: Helped topple Liz Truss’s government by starting Quantitative Tightening (QT) during her mini-budget chaos.

Later: Realised its own pension fund was imploding from QT-induced gilt losses.

Meanwhile, the Debt Management Office (DMO) — a Treasury agency — has issued the world’s highest proportion of index-linked debt,

about 30 % of borrowing rising automatically with inflation.6

That makes controlling prices a matter of national survival.

Yet nobody can clearly say who holds many of those bonds.

Rumours that China owns a meaningful slice of UK linkers might be speculative — but if true, Britain’s debt “partners” could exert uncomfortable leverage.7

The Coming Sterling Storm

When financing the deficit becomes impossible on the open market, QE will return, that’s what happened in Japan: Money will be printed faster than an Irn-Bru can rolling down Ben Nevis.

But unlike Japan, where debt is mostly domestic, Britain’s is largely held abroad.

Foreign investors, fearing depreciation, will sell bonds — and the pound will fall with them.

With Labour unwilling to cut welfare or abandon net-stupid-zero orthodoxy,

the UK is trapped.

Only a currency collapse can release the pressure.

Scotland’s Opportunity

Those who back an independent Scotland should be prepared to make the case for a Scottish currency. The Scottish Currency Group has made excellent progress in stating the options but broader debate is needed.

An independent Scotland with its own Central Bank, currency, and a Treasury could give us more tools to manage our own country. Here are a few of my thoughts:

A Scottish central bank could be more transparent than the BoE’s London elite.

It could adopt a dual mandate like the U.S. Federal Reserve — aiming for both price stability and full employment.

Interest rates could reflect the real economy north of SW1 — likely lower, spurring growth and tax revenue.

No more governors preaching climate virtue while crippling local industry. (Remember former BoE Governor Mark Carney? Grandstanding on climate initiatives then ditching his commitments as soon as he became Premier of our fossil fuels competitor...Canada.)

Fiat currencies worldwide are losing investor trust; gold keeps rising even with high rates.

Scotland could back its currency with tangible assets — land, energy, and commodities — restoring confidence.A targeted zero-corporation-tax policy for goods made in Scotland could re-industrialise communities Westminster left behind.

A currency that preserves its value is the economic essence of nationhood.

Scots can no longer afford to leave ours in Westminster’s hands.

So next time someone says, “North America feels expensive,” remind them:

it isn’t that the world got dearer — we got poorer.

That’s why Scotland must control its own money — to give the next generation an affordable stake in tomorrow’s technology-driven future.

Imagine an independence supporter complaining the deficit is unsustainable. Any sensible projection puts the Scottish deficit far higher than the UK. Best of luck setting up a central bank and currency from scratch. The speculators would run riot. I also note the conventional Tory argument for tax cuts. So much for voting for independence to have a more centre left country. It would be the same as Ireland, small c conservatism all the way.

~90-97% of money creation is by function of commercial bank lending & credit loans.

If you are worried about inflation blaming Govt Spending is barking up the wrong tree. Govt Spending via a Sovereign Currency is essential for a fully functioning society, there is no such thing as Central Bank Independence neither should there be.

Controlling the money lenders and Banking shysters is paramount.

https://chatgpt.com/share/68f0c9b5-24c8-800c-a722-30be16c80544