America: A Great State on the Slide

Trump’s Bill Bloats Deficit to $3 Trillion—While Musk’s DOGE Dance Distracts from America’s Debt Spiral

Wednesday 22nd May 2025 will see another “nail in the coffin” day for the United States of America’s claim to continued greatness, bringing nearer the day when China’s calculation of America’s fatal fiscal weakness will be proved correct.

Wednesday is when the House of Representatives is expected to pass Donald J Trump’s “Big Beautiful Bill” aimed at cutting taxes, more wall building, and increasing defence expenditure to a higher level than before, all in line with his campaign promise. Although the Republicans have majorities in the House and Senate, the Bill has not had an easy passage. The reason is debt, debt, debt, with a few Republicans in Congress holding back their votes, citing the debt as America’s Achilles heel – a country cannot forever maintain a strong economy, with military might, when trapped in debt so colossal it must borrow to keep borrowing, with debt interest payments rising exponentially.

The Trump Bill far from narrowing the gap between what the Federal government takes in taxes and what it spends, will increase it, with the budget deficit heading towards $3trn, all of which will be added to the National Debt. In this context the Musk DOGE is a PR stunt.

The debt level cap was supposed to work, but didn’t

In 1980 US national debt was 34.58% of GDP. By 2000 it was 57.84%, quite manageable, but now in 2025 it is 122.84%, forecast to rise to 134% by 2030. This situation has developed despite Congress setting a debt level beyond which the US government cannot borrow. The original “cap on debt” idea was meant to compel Congress and the Presidency to exercise fiscal discipline by keeping spending in line with tax income. Fat chance that proved to be. Since 1960 the debt level has been either suspended or raised 78 times, 49 by Republicans and 29 by Democrats.

The Treasury Secretary wrote to the House Speaker on 9 May advising that if the current debt level of $36.1 trn was not lifted, the USA would cease to be legally able to borrow come August. That would be a disaster because in August it will need to borrow to meet bond payment obligations, that is money already borrowed that needs to be paid back to bond holders (only a proportion of the total bonds issued) failing which the US Treasury will have its first debt default; something that would send another shock wave through the world financial system, including Wall Street. The answer? Take the debt level cap from $36.1 trn to $41.1 trn.

From world creditor to world debtor

Three Credit Agencies assess governments’ credibility as borrowers, which enable those buying government bonds to measure the risk involved. The higher the risk shown by Credit Agencies, then the higher interest rates they demand when buying the bonds. The USA, once the world’s largest creditor, rated AAA, is now among the world’s largest debtors. Save & Poor’s down graded it to AA+ some time ago. Fitch did the same. Now Moody’s has taken the rating down to Aa1.

USA 30-year bonds are now paying 4.937%, up from 4.786%, making debt interest payments higher than ever. Compare that with Germany’s 30-year at 3.02%. They key 10-year bond yields are USA 4.462%, Germany 2.57%. Those different percentage points are counted in billions when payment on debt interest comes due. Those high bond yields are applied to a country spending more than it takes in taxes. (UK 30-year yield is 5.480%, and 10-year is 4.65%. Germany is 2.57%)

The Wall Street Journal, a staunch Republican newspaper, devoted a full Leader to the debt issue: “The dollar’s reserve-currency status gives the US a unique borrowing privilege. There will always be buyers of treasury bonds, though the question is as what price?” going on to point out that debt interest “is already $900 bn a year.”

Geopolitical power is at stake

That unique borrowing privilege was being able to sell US Treasury bonds at lower interest rates than most other countries. Not any longer as the interest rates quoted above show. That matters not only to the USA tax payer, but also to America’s geopolitical position as a superpower. As the issuer of the world reserve currency, the one in which 80% of world trade is conducted, the US government, with effective control of the world financial system, can strangle another state’s economy as Iran has been finding out.

The dollar is a tool of American power. If its reserve currency status starts being questioned seriously, as is happening in some quarters with some pleasure (China, Russia, BRICS), that power is on the wane. The salient weakness of America now is that it relies on others to buy its ever-increasing bond debt. What if the Wall Street Journal is wrong, and those buyers, even at high interest rates, decide the risk is too high, and don’t buy? An American Armageddon.

America’s rising debt has been a topic among economists for some time, but has not been on the politicians’ agenda, with some notable exceptions. During the Presidential election debate neither candidate gave it a mention, no doubt because each was punting new tax cuts and spending, adding an extra $3-4trn to the total debt.

The USA is not about to fall off the financial cliff now, but the projections of debt and the burden of debt interest by sober economists point to a day of reckoning. If as some are forecasting the USA is heading for a recession, that day may come soon. With the debt figures in front of them, you would think the politicians would start trying to bring the Federal budget under some control. But as this Bill shows, the answer is no. Democrats cannot act, and are in any event the least likely to act. The Republicans are unable to, as most of them fear The Donald’s wrath if they don’t pass his Bill. They are heading into primary election time for the 2028 mid-terms, and ne word from Donald and they are damned.

The Bill for Trump’s Bill will come due one day. But it seems he doesn’t care. For this New York real estate hustler, the here and now is what matters. The word posterity seems not to be in his limited vocabulary.

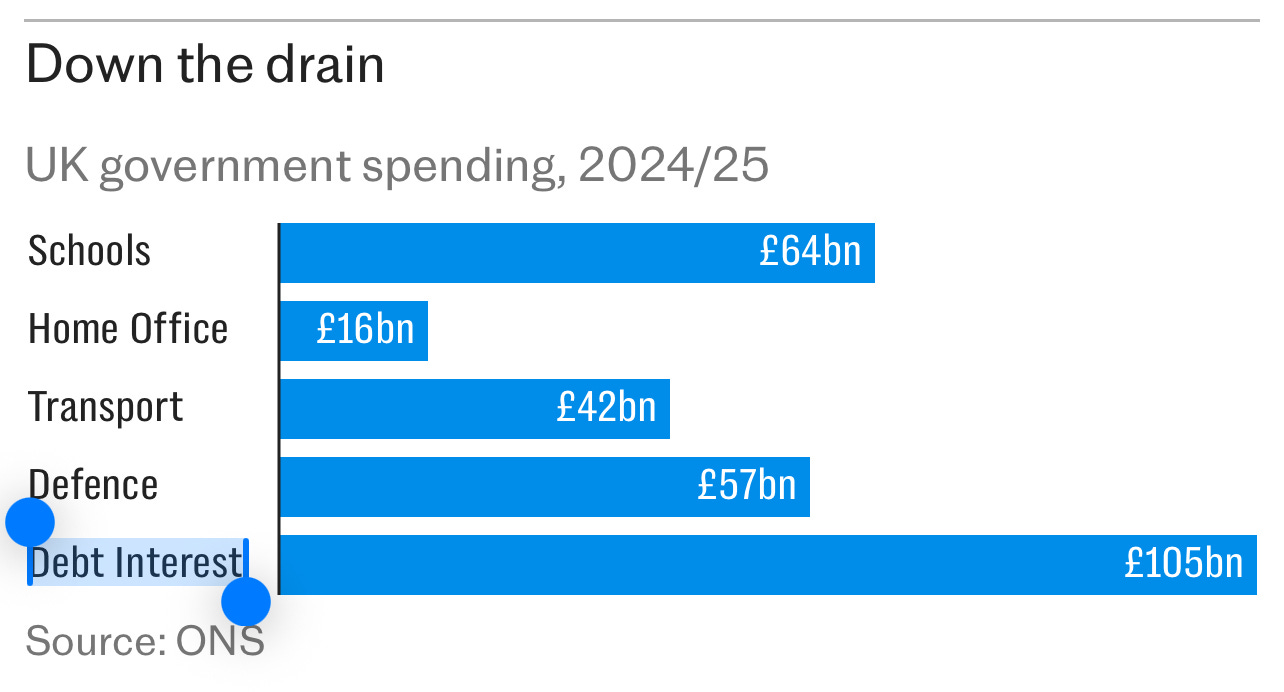

PS: Take another look at those UK figures. Starmer’s UK is in the same fix as Trump’s America.

I would argue that any default from the US on its debt - and a restructuring, which is part of the Miran Plan to change the Global Trading System, is technically a default - would be the United States’ second default. The first was on 15 August 1971 when it unilaterally reneged on its promise to pay dollar asset holders in gold at the fixed rate of US$35/oz. It made the argument that the dollar was as good as gold and everyone fell in behind but, to my mind, it was definitely a breach of a long-standing obligation. In other words, a default.

Yet Jim probably thinks an independent Scotland wouldn’t have a debt crisis, even though we would initially have no central bank and we clearly have a large deficit, which any sane economist acknowledges. Our public spend has contributed handsomely to they UK deficit. There would be turbo austerity for at least a generation.